Introduction

Opening your payslip can be quite a puzzling experience. We all eagerly search for that bottom-line figure – our take-home pay. But more often than not, it goes a little like this:

“Great, payday! Wait, that’s not what I expected. How much are they taking for taxes? And what’s that other deduction? Can’t be right… ?”

Does this sound familiar to you?

In this blog, we’ll help you understand your payslip, to help you make better financial decisions. We hope this comprehensive guide empower you with information to decode your payslip.

What is a Payslip?

Let’s start by defining a payslip. At its core, a payslip is a document that your employer issues, typically on a monthly basis, detailing your earnings and deductions for a specific pay period.

This tangible record of your salary serves as a financial compass, helping you navigate the intricacies of your income, taxes, and other financial aspects related to your employment.

Inclusions Listed in a Payslip

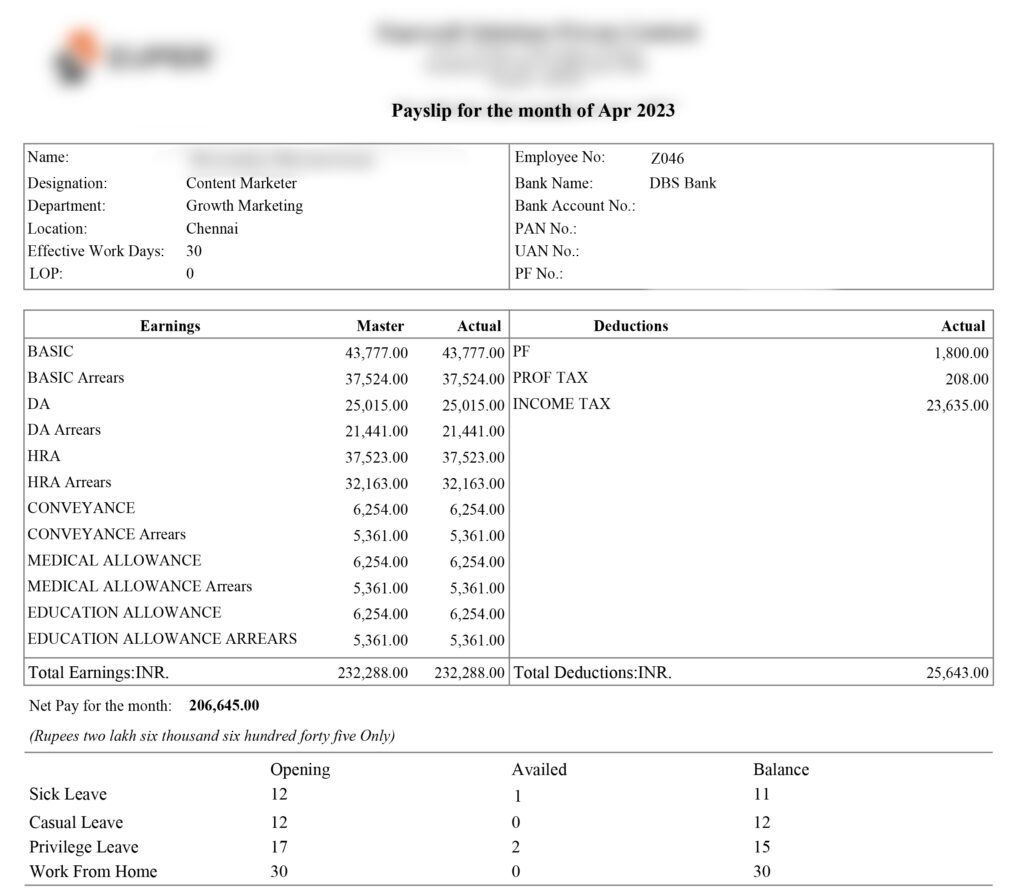

The above image is a sample payslip that will help us understand each component. Let’s look at the various components you’ll typically find on your payslip, through this sample.

Understanding the components of a payslip is essential for employees to manage finances effectively.

1. Personal Information

Your journey through the payslip begins with a brief introduction—a segment containing your personal details. As you can see in the top section of the image, that mentions the details of the employee. It includes your name, employee ID or code, address, and other identifiers. These details ensure that your hard-earned money reaches the right destination.

2. Earnings

Earnings constitute the backbone of your payslip. This section shows the diverse sources contributing to your total income for the pay period:

Basic Salary

The bedrock of your earnings, your basic salary forms the core of your compensation. It’s typically a fixed amount you receive consistently. In the sample, the basic salary is ₹43,777. It does not include any additional allowances or bonuses.

Additionally, basic salary forms the basis for calculating various other components of an employee’s salary, such as provident fund contributions and gratuity.

3. Allowances

Your payslip may list various allowances, such as House Rent Allowance (HRA), Dearness Allowance (DA), Travel Allowance (TA), or Special Allowances. Furthermore, these add-ons enhance your overall income and can vary based on your employment terms.

House Rent Allowance (HRA)

HRA is an allowance provided to employees to help them cover the cost of renting accommodation or paying for their housing expenses. In the sample mentioned, the HRA is ₹ 37,523.

HRA addresses the housing needs of employees. It is calculated as a percentage of the employee’s basic salary. It is partially or fully exempt from income tax, depending on the city and the actual rent paid by the employee.

Dearness Allowance (DA)

DA is an allowance provided to employees to counter the effects of inflation. It aims to ensure that employees can maintain their purchasing power. The DA in the payslip sample is ₹ 25,015.

DA is typically applicable to government employees and some public sector workers. It is usually periodically revised to keep pace with the cost of living changes.

Medical Allowance (MA)

MA is an allowance provided to cover medical expenses incurred by the employee and their family members. As mentioned above in the sample, the MA is ₹6,254. Evidently, MA helps employees meet medical costs, such as doctor’s fees, medicines, and hospitalization expenses. The amount may vary depending on the employer’s policy.

Conveyance Allowance (CA)

CA is an allowance provided to cover commuting expenses incurred by the employee when traveling to and from work. As mentioned above in the sample, Conveyance Allowance is also ₹6,254.

CA helps employees offset the cost of daily transportation to work. It is often a fixed amount or based on the actual distance traveled.

Special Allowance (SA)

SA is an allowance that employers provide to employees for specific purposes or as a flexible component that can be used for various purposes.

SA is more flexible compared to other allowances, and employees can use it for different needs. It is often paid as a part of the salary to account for any miscellaneous expenses.

4. Bonuses

Ah, the pleasant surprises! Bonuses represent additional payments, often linked to performance, company policies, or special occasions. They inject an element of unpredictability into your payslip.

5. Overtime

If you’ve dedicated extra hours to your work during the pay period, your overtime earnings are mentioned here. It’s a tangible reward for your additional effort.

6. Incentives

If your job includes targets or performance-based rewards, these incentives are listed in this section.

7. Other Benefits

This category encompasses a wide array of perks and benefits. Such as food coupons, medical allowances, mobile phone reimbursements, or any other supplementary payments that enhance your overall earnings.

8. In-hand Salary

In-hand salary is the amount that an employee receives after deductions. It is the amount that remains after subtracting taxes and other deductions from the gross salary.

In-hand salary is what an employee takes home and can spend or save. It reflects the actual cash that an employee receives in their bank account.

In the sample mentioned, in-hand salary is mentioned as the “net pay for the month” and amounts to a total of ₹ 2,06,645.

9. Cost to Company (CTC)

CTC represents the total compensation an employer is willing to spend on an employee annually, including all components of the salary, benefits, and bonuses.

CTC is gives employees an understanding of the overall value of their compensation package. It doesn’t include just the basic salary and allowances. It also included other benefits like provident fund contributions, bonuses, and any other perks.

Understanding the components of a payslip is essential for employees to manage their finances effectively and make informed decisions about their compensation. It also helps employers maintain transparency and ensure that employees receive a fair and competitive salary package.

10. Deductions: The Necessary Subtractions

Regrettably, not all your earnings are yours to keep. Deductions form the subtractive side of your payslip, accounting for various financial obligations. Common deductions include:

Income Tax

The formidable force of taxation makes an appearance here. It’s the portion of your income that the government claims, and the amount deducted is typically based on your income level and tax-saving investments. It is generally the highest of the deductions. As mentioned in the sample, it amounts to ₹23,635.

Employee Provident Fund (EPF)

The EPF deduction is a compulsory contribution to your retirement savings. Both you and your employer make contributions, and the deducted amount accumulates over time, securing your financial future. Under the regulations of EPF, 12 percent of your earnings are required to be contributed towards your provident fund. As mentioned in the sample as PF, it amounts to ₹1800.

Professional Tax

In certain states, professional tax is levied on salaried individuals. This state-specific deduction helps fund local governance. The amount as you can see in the sample is ₹208.

Insurance Premiums

Payments towards insurance policies, including health insurance, life insurance, or any other coverage that your employer provides, are accounted for here.

Loan Repayments

If you have any outstanding loans, such as car loans, home loans, or personal loan, the EMI deductions are mentioned here. This ensures transparent tracking of your debt repayments.

Other Deduction

This catch-all category includes various other miscellaneous deductions, such as contributions to social or charitable causes, union fees, or any unique financial obligations specific to your employment

Why Is It Important to Understand Your Payslip?

Knowing what’s on your payslip is not just about curiosity; it’s a practical and essential skill for several important reasons:

- Financial Awareness: Understanding your payslip gives you a clearer picture of how much you earn and how much the employer is deducting. This helps you make smarter financial choices.

- Better Budgeting: When you know your income and deductions, you can further plan your spending more effectively. This means you can budget for your future needs and avoid spending too much.

- Smart Tax Planning: Your payslip has info about how much tax you pay. When you understand it, while filing taxes you can find ways to pay less tax legally and save more money.

- Savings and Retirement: Part of your salary might go into a retirement fund. Knowing how this works helps you plan for a secure financial future.

- Managing Loans: If you’re paying off a loan, your payslip serves as a reminder of how much you deduct each time. This helps you keep track of what you owe and manage repayments well.

- Negotiating Salaries: When you understand your payslip, you’re better equipped to discuss your salary when looking for a raise or a new job. You’ll know exactly what you’re worth.

- Spotting Mistakes: Sometimes, payslips have errors. When you understand yours, you can quickly spot and fix these mistakes to make sure you’re paid correctly and get the benefits you deserve.

In Conclusion

Your payslip, often overlooked in the busy work routine, holds the key to your financial health.

It’s not just a piece of paper; it’s a reflection of your efforts and commitment. By examining and understanding the information on your payslip, you can make better financial decisions and take control of your finances.

So, when you receive your payslip next time, don’t just glance at it – take the time to understand the numbers, look at the deductions, and empower yourself with financial knowledge.

Comments

One response to “Understanding Your Payslip”

nice blog